As property buyers we dramatically changed our preferences for location and property types.

While another noticeable effect was the spike in housing prices, which was further driven by lower interest rates. However housing price increases are starting to slow now interest rates are on the rise.

The following is a short summary of the top 4 COVID-related changes we’ve seen in the property market.

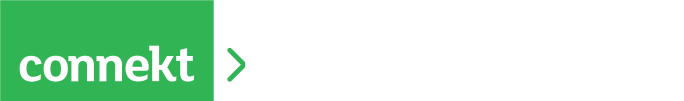

One of the sharpest adjustments in the property market happened early in the pandemic when people moved into smaller households.

Amid lockdowns and remote work and study, more people decided they needed their own space.

One-and-two-person households became more common in 2021 than was the case in 2016 – at the expense of larger households.

In particular, share houses dropped in popularity during COVID. With university learning going remote, and many retail and hospitality businesses shut, shared living was much less appealing.

Nationally, the average household size fell from about 2.59 people to 2.55 people. While this may not seem like much, it meant we needed about 150,000 more properties to house the population than we would otherwise.

That’s equivalent to almost a year of residential dwelling construction!

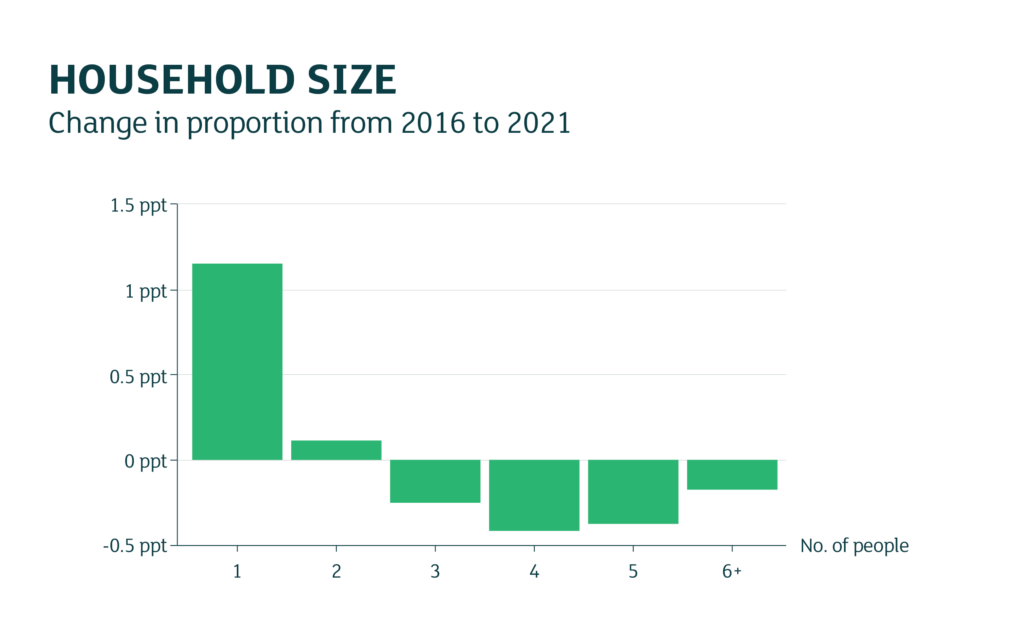

Regional areas across the country increased in value as remote work capabilities and a desire for lifestyle changes prompted some people to move out of the city.

This regional revival also benefited smaller cities with lower home prices, namely Adelaide and Brisbane.

Although prices have increased all across the country, Tasmania, Victoria, New South Wales and southeast Queensland were the biggest winners with the greatest price increases.

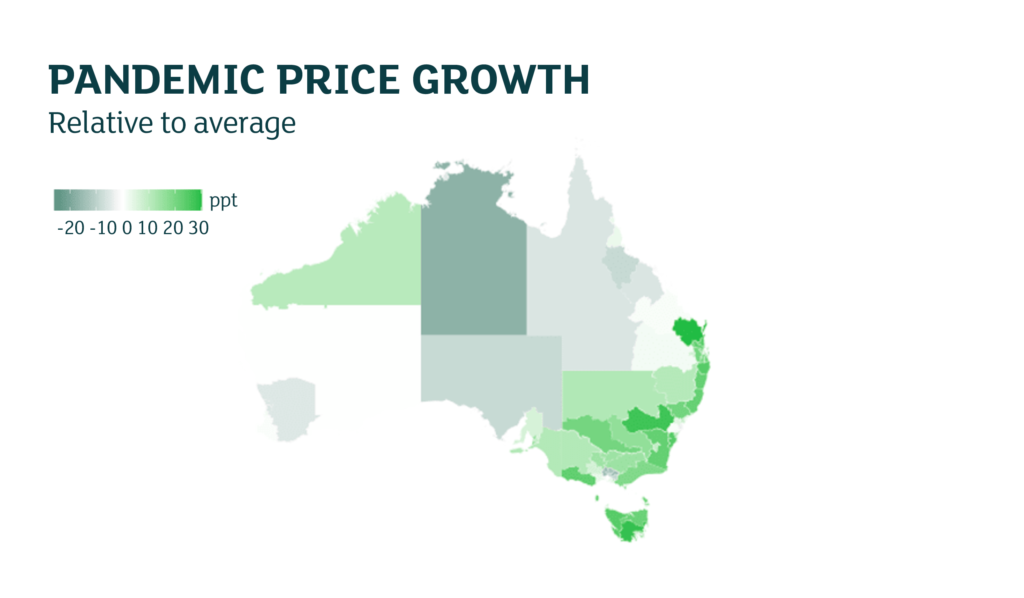

The other key change among homebuyers has been the desire for larger homes.

With remote work rising and people spending more time at home, buyers now want more rooms for home offices, as well as larger yards and utility spaces.

This has been clearly evident in selling prices. The amount people are willing to pay for large homes relative to smaller ones has greatly increased.

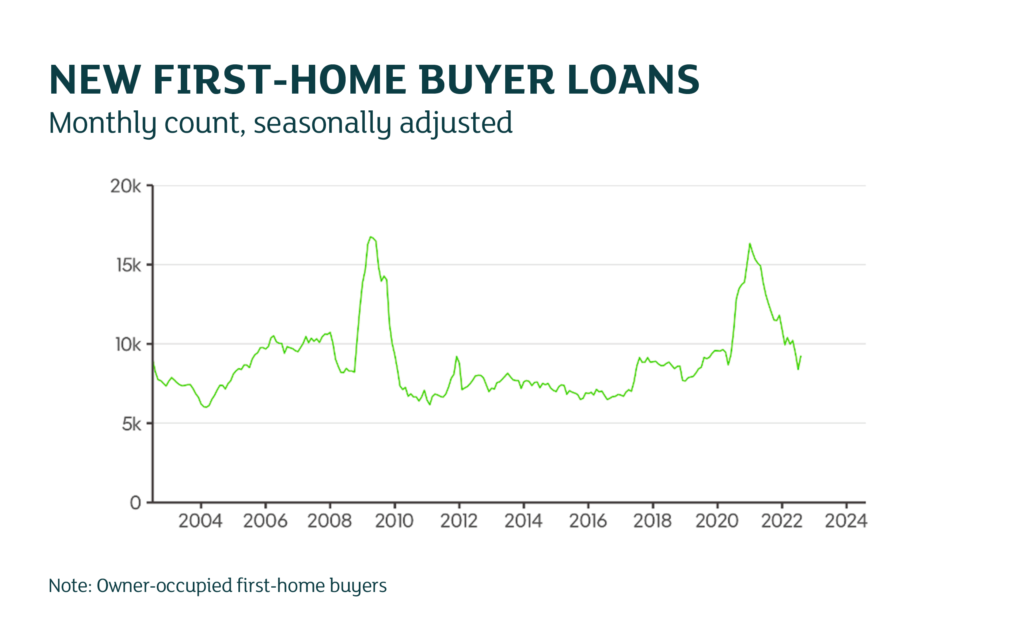

The pandemic period has been good for first home buyers. This was due to a combination of lower interest rates and Government initiatives such as SA’s First Home Owner Grant.

This surge in demand without a change in supply meant rental price increases, which have been very strong and look set to continue. This in turn saw a spike in first home buyers who chose buying over renting a property.

Whether or not these trends will reverse isn’t entirely clear, however, it appears to be likely.

Higher interest rates are likely to mean first-home buyers will find 2023 more difficult than over the past two years. This, combined with ongoing strong rent price growth, is likely to slowly revert the pandemic shift to smaller household sizes.

To some extent, households were able to spread out following the reduction in housing demand throughout the pandemic but will now have to group back together.

The persistence of preference shifts towards regions and larger homes is harder to predict.

But given we have seen little reversal in these trends yet – regional areas continue to outperform capitals, and the premiums for large homes are little-changed – they appear to be long-term changes in the housing market.

If you have any questions at all around decisions to do with house buying, the highly experienced team at Connekt would be glad to pass on advice. Connekt with us at projects@connektup.com.au